Finance technology consolidation is an essential step for financial organizations that want to remain competitive, ensure efficiency, and build a strong employee experience. By consolidating tech solutions, financial institutions can meet major industry challenges to serve a diverse, dispersed workforce, maintain data security and compliance, and drive engagement among employees in high-stress positions. This article outlines how to make it happen.

Finance is a complex sector. Whether you’re a commercial or investment bank, insurance company, brokerage firm, credit union, or another type of financial institution, there’s a lot to consider when it comes to the digital workplace.

Companies operating in the finance space have several unique challenges – from maintaining compliance to combatting higher-than-average employee stress levels – that can be either exacerbated or improved by their technology choices. Right now, the sector (like all sectors, from retail to healthcare to construction to franchise) faces one especially significant tech-related roadblock: too many software solutions.

This glut of employee technology has broad implications for financial institutions, and to truly improve operational efficiency, staff experience, communications, and compliance, organizations need to consolidate their solutions to optimize technology and create a streamlined digital workplace. A comprehensive employee experience platform can help them achieve their consolidation goals.

This article will dive into why tech overload can be so damaging for financial institutions, what considerations finance organizations should make when consolidating technology, and how an employee experience platform can help streamline technology.

Your roadmap to digital workplace consolidation

The implications of tech overload for the finance sector

Tech overload is a common problem for financial institutions. Over time, as their digital workplaces expand, more and more apps and platforms tend to accumulate. This is especially true for large institutions with a presence in several markets and regions, which may use different solutions for similar purposes in various locations. When platform accumulation gets out of hand, it can wreak havoc on efficiency, communication, employee engagement, and even security. Finance companies often find themselves with countless single-purpose apps cluttering their digital workplaces, including:

- Knowledge and asset management platforms

- Employee communication apps

- Data analytics software to measure engagement and productivity

- Enterprise social networking solutions

- Onboarding and offboarding software

- Workflow apps for common tasks such as booking travel or submitting expenses

The list can go on and on, with larger enterprises averaging over 200 apps in their digital workplaces according to research from Okta. Utilizing more apps doesn’t mean greater efficiency – in fact, it reduces technology adoption and makes it even harder to find information, communicate, and complete tasks.

There are several reasons why it’s essential that institutions prioritize finance technology consolidation strategies to cut down on the number of solutions in place:

Implications for employees

An overabundance of apps can negatively impact the day-to-day employee experience in a few different ways. The first issue is digital confusion. Employees confronted with too many solutions often don’t know where to turn to find information, collaborate with coworkers, complete tasks, or connect with others. In the fast-paced world of finance where every minute counts, this can be incredibly frustrating. It also makes employees more likely to contact teams such as HR or IT to get things done, defeating the purpose of having these apps in the first place (more on that below).

Furthermore, busy finance employees may not feel they can devote time to a multitude of different solutions. They’re especially unlikely to visit different apps or websites for activities that seem irrelevant to immediate day-to-day tasks (think employee recognition software, company news channels, and idea management platforms). This can cause engagement, wellbeing, and organizational culture to suffer.

Employees who deal with too many apps can also miss out on crucial information. According to one survey, 36% of employees say they’ve missed important updates due to the number of applications used and the volume of information produced on them. With several internal comms channels to keep track of, limited time to check different locations for updates, a large amount of irrelevant content, and resistance to using the platforms where this information lives, it’s easy for employees to be out of the loop. This hurts their abilities to do their jobs effectively and lowers organization-wide efficiency.

Implications for IT

In finance, a security breach can be devastating, so institutions must be vigilant to prevent any possible threats. For IT teams, tech overload means not only more vendors to deal with and more platforms employees will need tech support with, but also increased security risk. Every separate solution presents a new attack surface for a potential security breach, so each needs to be vetted carefully and reevaluated regularly, multiplying the IT work required and increasing opportunities for error. Having fewer platforms is the safer choice.

It’s no surprise then that IT execs are prioritizing finance technology consolidation. A recent survey by CIO magazine found that 95% of CIOs plan to consolidate IT vendors in the next year. This is a smart move that ensures IT teams can effectively protect their organizations.

Your roadmap to digital workplace consolidation

Implications for HR and Internal Comms

Excess technology solutions also cause issues for HR, people experience, and internal comms. Having many single-purpose options for functions such as training, sharing company information, employee recognition, and more makes very little sense in the modern digital workplace. These teams need a unified communication and knowledge management platform – without one, their workloads rise and their effectiveness decreases.

When there are too many channels, it’s hard to inform an audience of diverse, often widely dispersed finance workers who need to know about important updates, policy changes, and digital workplace processes. If this information is hard to access, employees tend to reach out to the teams in charge individually with their questions, creating unnecessary work and wasting everyone’s time.

Moreover, key opportunities to build a high-quality employee experience and culture can be lost in a sea of apps and platforms. Especially in a fast-paced industry where the geographical spread of employees is common, these are things that can’t be ignored. The use of a single, comprehensive digital workplace platform, on the other hand, can promote brand values, encourage community, and make it easier for employees to engage with their peers.

The right employee experience platform can help financial institutions put a stop to the damaging impacts of tech overload. It can facilitate dispatching key information to a wide range of employees, maintaining compliance, promoting employee engagement, and more. Before we get into the specifics of employee experience platforms for finance, let’s examine some factors to keep in mind when planning for finance technology consolidation.

Considerations for finance technology consolidation

The fast-paced, complex, and data-driven environment of finance organizations presents a unique set of communication and employee engagement challenges. These challenges make the impacts of tech overload even more damaging and are important to consider when approaching finance technology consolidation.

With a significant need for international collaboration and regulatory compliance, finance organizations must provide audiences of tech-savvy employees with best-of-breed software solutions, and consolidation is key to doing so.

Data privacy and security

As discussed above, financial institutions operate under intense scrutiny regarding data privacy and security. Sharing sensitive information internally requires secure communication channels and careful training on compliance protocols. This can restrict open communication and collaboration. Similarly, a permissions-driven approach to content publishing is essential as not all employees require access to all information. In a fragmented workplace, publishing multiple versions of redacted content for different audiences is manual and time-consuming, and leads to silos of knowledge.

With a consolidated digital workplace platform, security zones on personalized intranet homepages mean that only relevant, approved content is surfaced for different users, making data security paramount.

Reaching all employees

From traders and bank tellers to compliance officers and back-office staff, financial organizations encompass a diverse range of professionals with specialized knowledge and communication needs. Reaching everyone effectively with relevant information can be challenging.

With the rise of remote work and distributed teams across different time zones, maintaining consistent communication and fostering team spirit becomes more complex. Timely information sharing and aligning everyone on strategic goals can be difficult. In this scenario, corporate communicators and HR require granular audience targeting features, AI-powered content creation, and engagement analytics for a global audience.

Ensuring wellbeing, productivity, and retention

Competitive, performance-driven cultures can lead to high stress levels for employees. In addition, long working hours and demanding schedules can contribute to work-life imbalance, further affecting wellbeing and productivity.

A unified solution that encompasses multichannel communication, employee feedback loops, peer-to-peer engagement and recognition, and dedicated spaces for initiatives promoting work-life balance and career development can address these challenges. Rich-media communications and content focused on fostering cohesion between diverse groups can help to counter dips in morale.

Your roadmap to digital workplace consolidation

How an employee experience platform can facilitate finance technology consolidation

To ensure success, finance institutions must combat the industry challenges laid out above, ensuring security while still making it easy for employees to access what they need, connecting a complex workforce, and creating a strong culture despite time constraints. Replacing many different apps and platforms with a single, multipurpose solution is the first step to making all of this happen.

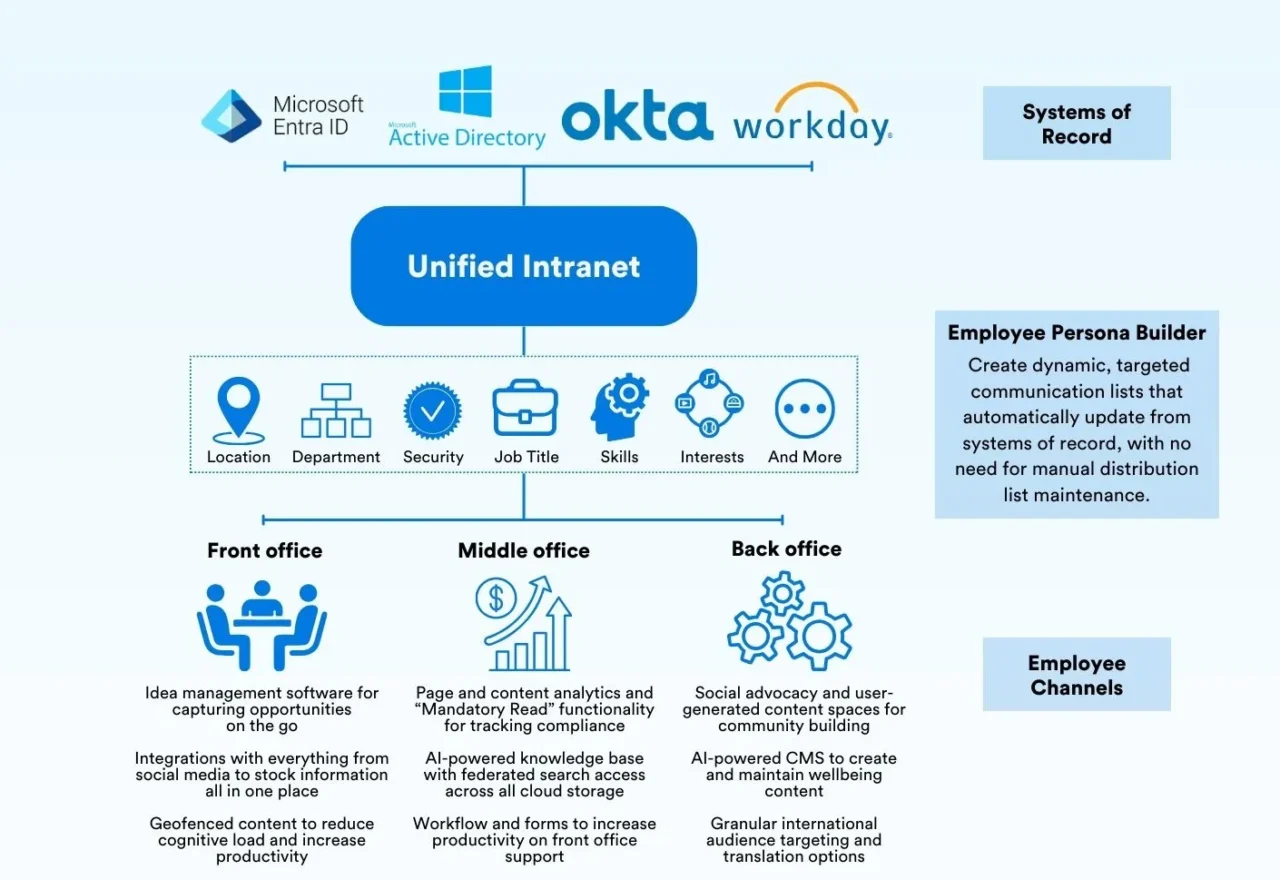

A comprehensive employee experience intranet can help make finance technology consolidation possible while better meeting business needs. The right platform will replace many other apps and provide employees with the tools and resources they need to get things done in a single, easy-to-access location.

A high-quality employee experience intranet will allow financial institutions to:

- Ensure data security with advanced permissions features that control access to information

- Personalize the digital workplace based on location, employee role (e.g., teller, customer service rep, corporate staff, etc.), or other characteristics, making sure staff have immediate access to the workflows and information relevant to them

- Communicate effectively with employees across roles and regions using audience targeting, AI-powered content creation tools, and engagement analytics

- Streamline collaboration with up-to-date people directories, department-level pages outlining processes, and even translation features for international employees

- Engage employees by creating opportunities for community and building a cohesive culture with employee recognition, feedback management, and other features.

- Provide easy-to-access resources for employees in high-stress positions who may be battling burnout

- Keep employee training and compliance up to date with mandatory reads and automated reminders

- Improve the effectiveness of HR, IC, and IT teams by reducing the number of vendors, the effects of employee app overwhelm, and the need to manually support processes that should be automated

These benefits just scratch the surface of what an employee experience platform can deliver. The right solution will be packed with all these features and more and is essential to consolidating the finance digital workplace.

Your roadmap to digital workplace consolidation

Finance technology consolidation in practice at Alliance Bernstein

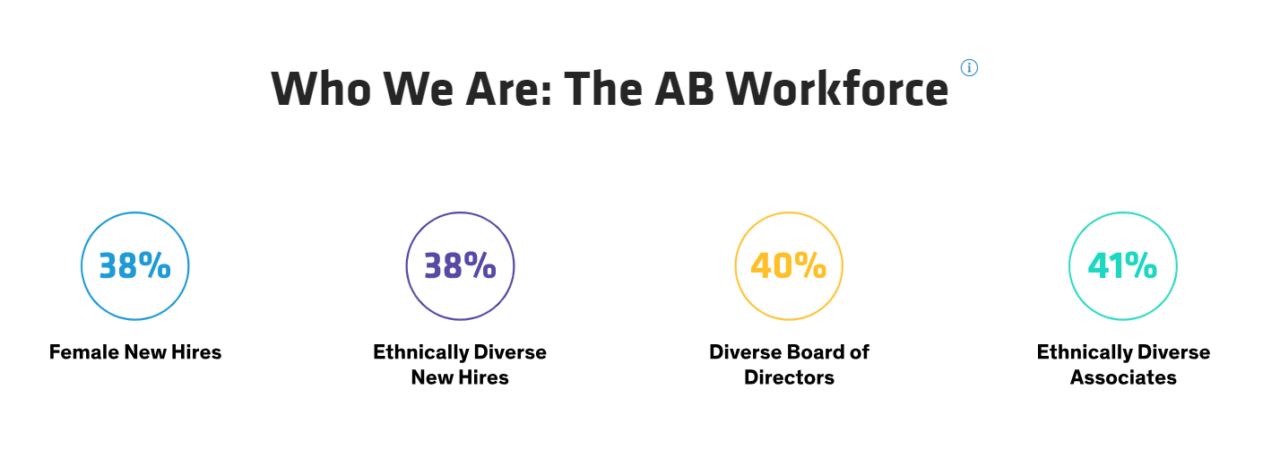

AllianceBernstein (AB) is a global asset management firm providing investment management and research services to institutional, high-net-worth, and retail investors. With headquarters in Nashville, TN, it operates worldwide, managing assets worth $686 billion and generating $3.7 billion in revenue.

The goal: A cohesive, inclusive workplace that unites and supports busy finance employees

AllianceBernstein’s team hoped to foster a dynamic, diverse, and inclusive workplace where all employees feel valued and empowered. This includes supporting the many employee resource groups across the business.

How a single employee experience intranet made it happen

AB has implemented a comprehensive Diversity, Equity & Inclusion strategy, earning accolades that include a perfect score on the Human Rights Campaign Foundation’s Corporate Equality Index for six consecutive years.

The firm’s intranet, The Loop, serves as a hub for celebrating achievements, providing ongoing learning resources, and delivering messages from senior leadership, reinforcing AB’s dedication to promoting diversity, equity, and inclusion.

Implementing this type of comms strategy to promote employee engagement and belonging is essential for financial institutions, whose employees risk a heavy workload and organizational silos. The intranet makes it possible, ensuring reach and making employee participation easy by hosting it on a single platform that employees already use regularly.

Consolidating finance technology with an intranet

In the fast-paced world of finance, employees are frustrated by the tech overwhelm that comes from an excess of apps and platforms. IT, IC, and HR teams are frustrated by the inefficiencies, security risks, and compliance issues this causes.

Finance technology consolidation is essential, but planning and executing an effective strategy can be intimidating. The right feature-rich intranet platform will replace countless other applications, providing a comprehensive digital workplace solution that has everything employees need in one place. The right choice will ensure security, connect employees across national and international locations, improve efficiency, and boost employee engagement, providing the streamlined workplace finance organizations need.