A structured communications strategy for M&A activity is critical for employee wellbeing. Without it, a business may profit financially but workers can suffer from anxiety and burnout. How can communicators get M&A communications right?

In 2020, my working life was upended when the company I worked for was acquired. Fortunately, I kept my job and then went on to work for the parent company as it made multiple new acquisitions over the next year. Inorganically adding more employees, more communications, and more clients in a short amount of time was difficult and I learned that employee communications during mergers and acquisitions (M&A) have a huge impact on wellbeing, productivity, culture, and longevity.

How acquisitions affect employees

If you’ve never been through a merger or acquisition as an employee, it’s not much fun. Despite assurances from senior leaders, rumors start to circulate and people quickly begin worrying that they will be surplus to requirements, that their workplaces will be closed in favor of another city, or that the new direction of the company won’t suit their skills and interests.

There’s no way that senior leaders can assure everyone that their jobs are safe. Situations move fast and no one knows all the answers. If they’re transparent, they’ll admit that they won’t know them until all the due diligence is done and operations have been put in place.

For the company being acquired, the anxiety is especially great.

“Who is my counterpart? Are they better than me? Will there be room in the new department for my skills? Who is this company and do I even want to work for them?”

Multichannel communications: How to plan and execute a strategy

An employee might do some hasty reviews of Glassdoor, but that probably won’t say everything they need to know about company culture. Typically, the acquired company is smaller than the buyer (maybe a startup) and so the worry is that the existing company culture will soon be lost in the workings of a bigger beast.

An employee communications plan during mergers and acquisitions will not be able to answer all those questions because even the best employee FAQs can’t cover everything. What a structured communications strategy must do though is be as honest and organized as possible to ensure that the impact on anxious employees is lessened.

M&A is an important part of modern workplaces

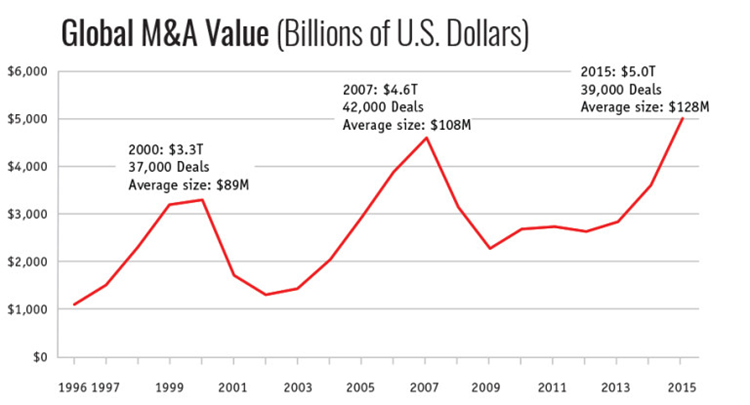

Company mergers and acquisitions have been making headlines for decades, but in the last few years the trend has accelerated. In 2016, Harvard Law School identified what it called a “mega-merger explosion”. At the time, this involved a record high number of M&A deals that generated $5 trillion for the global economy.

Even with the challenges of the Covid-19 pandemic, M&A has continued to thrive. In August 2021, data revealed that global M&A was already in excess of $3.5 trillion. Why so much activity? From a commercial perspective, acquisitions can help bigger companies scale faster and they allow smaller companies to receive investment. Mergers are also beneficial as they can consolidate key players in a market. Clearly there are commercial advantages to both arrangements that mean organizations will continue to pursue them.

However, the effects on company culture, employee experience, and engagement can be detrimental. How can HR departments and internal communicators already navigating the employee retention crisis of the Great Reshuffle ensure that employee acquisition communications are useful and reassuring? Two ways to think about how communications can impact employees include strategy and technology.

Build a strategy for employee communications during mergers and acquisitions

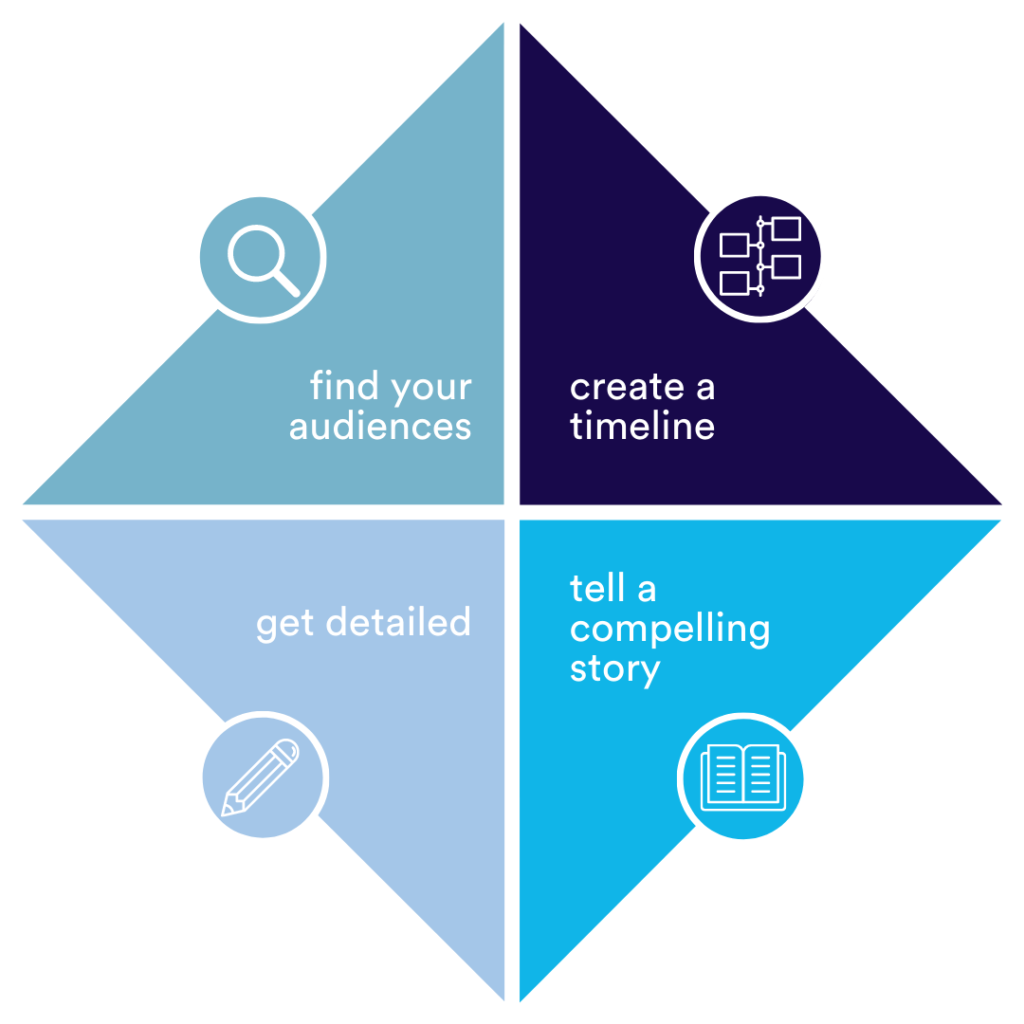

- Find your audiences

The internal audiences for acquisition communications include the employees of both companies, but messaging may also fan out to key commercial partners and consultants. The use of contractors and offshore resources should also be considered when planning.

Although the overall message may be universal, internal groups will have very different needs and expectations. When planning a strategy, identify generational and role-based differences and think about how granular you want your targeting of these groups to be. Should employees over 50 receive more information about pension benefits than those at the start of their careers? Do frontline employees need extra tech support than those in offices?

When thinking about the different audiences and the messaging they need to receive (some will be high-concept storytelling, some will be micro-detailed), it’s important to lay out a multichannel approach. If certain elements of a workforce are considered a churn risk, face-to-face communications may be used in addition to video or the written word. Communicators may need to work closely with HR to determine which departments and locations face higher risk of a skills drain if employees decide to leave. Either way, a good mergers and acquisitions communications plan will make use of multiple channels to get the messages out and to increase employee engagement.

- Create a timeline

In my experience, a communicator (whether it’s a marketer or someone in internal comms) will naturally be central to M&A communications activity. They are brought in early and often asked to work with senior leadership to develop a message that will work internally and externally.

There are a lot of moving parts to M&A communications: deals are frequently delayed, there are multiple groups to inform at different times, and things rarely run like clockwork. For this reason, it’s important to have an extensive communications plan timeline that accounts for change.

Leak prevention, employee updates, customer updates, pre-release to selected media partners, press releases, social media teasers, and posts are all important factors to consider.

To ensure that employees are at the heart of your approach, ensure that they are informed via several media prior to any public release. Not only will you need employees to feel settled and comfortable with the decision, but when the time comes for public updates, you need them to be fully informed evangelists. Provide them with FAQs and talking points via intranet software, email, meetings, and any other channel you use. Simply sending an email and hoping they read it in advance of a deal won’t cut it.

- Tell a compelling story

Although senior leadership will have strategic reasons for M&A activity, the communicator’s role is to work with all stakeholders to tell a story that resonates with employees. Employees may be less interested in company profits than shareholders are, so it’s critical to determine the “what’s in it for me?” factor.

By adopting ideas that will capture employee imagination, it’s possible to develop a better value proposition for workers. Will the deal lead to more internal opportunities? Are there likely to be individual benefits or a positive change in company culture? If the deal is a merger with an organization known for DE&I or ESG commitments, this may represent a fantastic moment to share good news with employees.

Having identified different audiences, the communications team will also be able to assess whether different groups will need to hear slightly different versions of this story. If the deal is part of a company acquisition, for example, the acquirer’s workforce may be interested in hearing about increased opportunity. The workforce in the acquired organization, however, will need to hear a different story about the opportunities and benefits that will make them wish to stay.

- Get detailed

Communication is an important part of the M&A workstream, but it is also a highly collaborative process. Input from Legal, Finance, and HR will be especially important as you all work to tight deadlines.

Perhaps the most critical thing to bear in mind is that you may also have to work and plan with people in another company. Your interactions with them may be restricted by time, distance, or regulations, however. For this reason, detailed planning and the creation of a structured communications plan that mirrors the M&A timeline is key.

Every meeting has to count and to be productive. There probably won’t be many of them before the launch. Work collaboratively to produce a detailed map of who is responsible for which pieces of communication, who will design them, and who will post them on different platforms. Again, as you may be working across more than one company, detailed planning for more than one workforce is a crucial element. Giving comms to one workforce but not the other can be damaging for morale.

On the issue of keeping morale high, one of the most damaging parts of mergers and acquisitions can be the lack of transparency around your new colleagues. Are they like us? Do they work in the same way as us? Will we get on and how closely will we have to work together? While some companies try to keep new colleagues separate until the very last moment, others take a different view.

Recently, the London Stock Exchange Group (LSEG) won the Best corporate internal comms or employee engagement campaign award from PRWeek for its ‘First 100 Days’ campaign. Following LSEG’s acquisition of Refinitiv, the group’s employee base went from 5,000 to 25,000 in a short space of time. This major shakeup meant that LSEG needed to create a major internal comms campaign. One of the aspects which drew my attention was the inclusion of an employee to employee communications activity called “Company Roulette”. New colleagues from both businesses were randomly drawn to meet and introduce themselves, in a way which helped to break down barriers.

Multichannel communications: How to plan and execute a strategy

Use technology as part of your internal communication strategy

In addition to creating a sample communications plan for use during mergers and acquisitions, technology is also a key consideration.

Crafting resonant messages and orchestrating their delivery is not just about the skill of the communicator, but about the technologies they have at their disposal.

By using internal comms tools to deliver, track, and analyze employee communications, you can ensure the message has a better chance of succeeding. This is where multichannel digital workplace tools such as intranet software comes in. Not only does a CMS intranet that enables a consolidated content creation and distribution experience help communicators, it’s better for employees.

Not every employee spends their working days at a desk or has the time to watch lengthy video calls. Alerting them through SMS, mobile app notifications, or via digital signage, can ensure they pull towards the information as well as having it pushed to them. If all else fails, mandatory read technology can ensure that employees are notified and re-notified in an automated way until they have definitely received the right messages.

In addition to the communications angle, intranet software can help new and existing employees as they adjust to organizational change. A people directory, coupled with populated user profiles, can enable new colleagues to find out more about each other. Enterprise search can ensure that everyone can find critical comms or HR documents. Blogs and social intranet features can break down walls.

Learning for next time

In my experience, there was always a next time, and a time after that. Asking how to tell employees about a merger became a regular Google search. Despite the constant activity though, all these flurries of activity lacked an easy system to see data on how employees had received the messages. Without pulse surveys it was hard to gauge sentiment. Likewise, without data analytics on content page views, it was impossible to discern what people were reading.

Company to employee communications and employee to employee communications are so important that their delivery and feedback should not be left to chance. If your organization wants to do a good job of delivering employee communications during mergers and acquisitions, investing time in a structured communications plan and the right technology may help.